ВЈ100 – ВЈ5,000 given out by 12:00pm

Just how much do you want?

Representative 669.35% APR

Your earnings and expenditure ebb and flow each month, while you manage cash going using your home. Under perfect  conditions, profits surpass month-to-month outgoings, addressing your obligations, with cash left for cost cost savings along with your other monetary priorities. Used, nonetheless, unanticipated cost and economic force can pose dilemmas. When spikes that are spending unexpected monetary challenges stress your allowance, you could experience shortfalls before payday. Whether you have got good or credit that is bad pay day loans offer simple usage of fast money, utilizing your future payday being a payment guarantee. Bad credit payday advances complement various alternatives that are funding to British credit customers.

conditions, profits surpass month-to-month outgoings, addressing your obligations, with cash left for cost cost savings along with your other monetary priorities. Used, nonetheless, unanticipated cost and economic force can pose dilemmas. When spikes that are spending unexpected monetary challenges stress your allowance, you could experience shortfalls before payday. Whether you have got good or credit that is bad pay day loans offer simple usage of fast money, utilizing your future payday being a payment guarantee. Bad credit payday advances complement various alternatives that are funding to British credit customers.

Simply how much do you need? Are Bad Credit Payday Advances The Same As Other Loans?

Prices from 49.9per cent APR to max 1333% APR. Minimal Loan Length is 1 month. Optimum Loan Length is 3 years. Representative Example: ВЈ250 lent for thirty days. Total quantity repayable is ВЈ310.00. Interest charged is ВЈ60.00, annual interest of 292% (fixed). Representative 669.35% APR (variable).

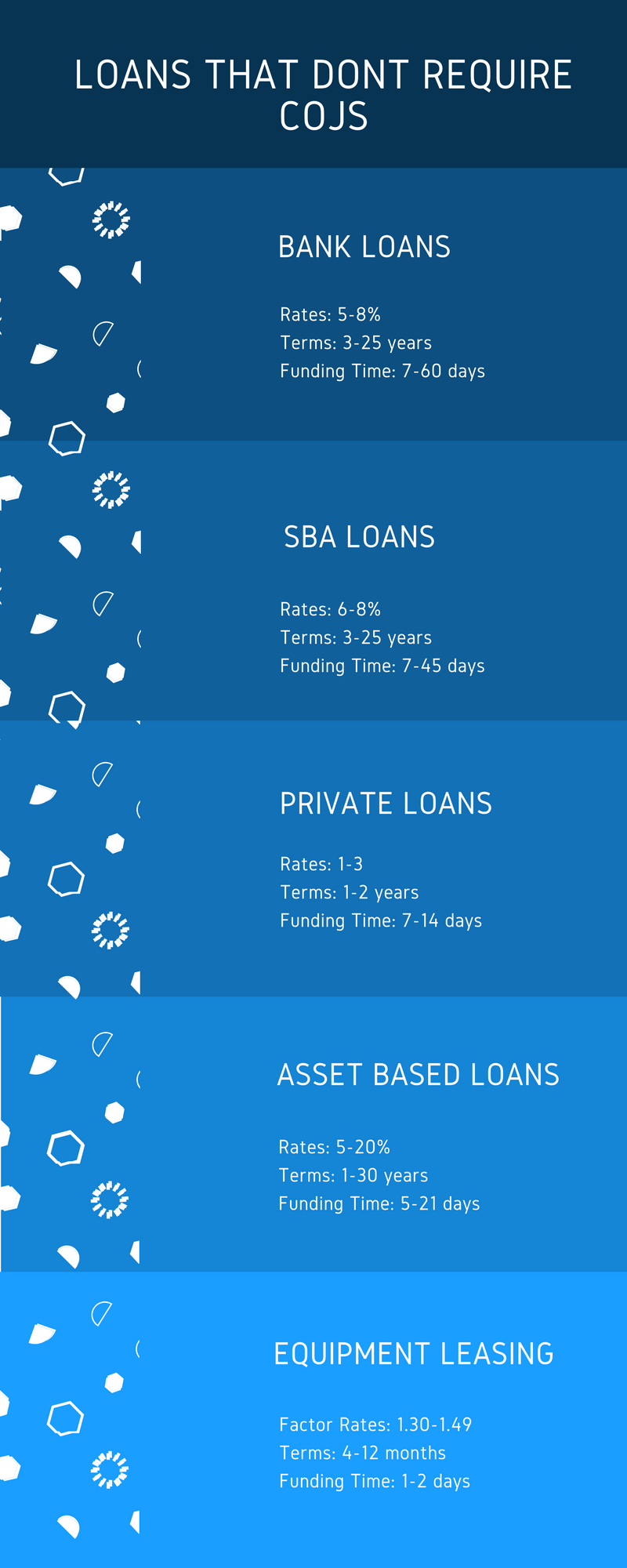

Different finance options originate at banking institutions and building communities, whilst several types of short-term loans can be found on the web. Banking institutions, home loan organizations, credit unions, as well as other traditional lenders usually help with long-lasting loans, guaranteed by real home. Mortgages as well as other secured personal loans provide low interest, supported by the worth for the home bought.

Home loan danger is fairly low for loan providers, because the property can be sold by them to recuperate losings, in the eventuality of standard. Short term loans and revolving credit reports are at the mercy of greater interest levels, considering that the debts aren’t supported by real home. Bad credit loans along with other payday items are maybe maybe not secured by conventional security, however the loans solution working candidates, utilizing their future earnings to ensure repayment that is timely. Because online lenders concentrate on your work status and earnings, versus deep credit score, pay day loans, quick loans, along with other credit that is instant fund quickly, without waiting really miss acceptance.

Loan providers have to give consideration to credit conditions prior to making loan provides. Main-stream organizations stay glued to strict credit scoring criteria, commonly subjecting each applicant to a credit check that is extensive. The procedure assists banks make lending decisions, however the conventional application and approval duration doesn’t deal with every applicant’s require for rate.

On the web lenders specialise in supplying usage of cash without delays. Although acceptance for online loans additionally calls for credit review, fast pre-approval shortens turnaround times when it comes to little specialty loans.

Qualified candidates must meet basic eligibility needs for online loans. So that you can get an online payday loan you must :-

- Be at the very least 18-years old whenever you submit an application for a quick loan.

- Demonstrate your capability to settle the mortgage – payday, profits, work status, etc

- Have a home in the united kingdom

- Have current account from which in order to make re re payments and to get loan transfers

Your credit score reflects interactions with landlords, loan providers, creditors, along with other creditors. TransUnion, Experian and credit that is similar maintain step-by-step records about past and current records, aswell data gathered from general public sources. Along with keeping your own credit rating for every person, reference agencies further simplify the credit rating procedure, numerically rating each customer with your own credit “score.”

Credit customers are each assigned a score that is three-digit showing information found in individual credit history. Your figure represents a“credit that is personal” summing up your whole finance history. If you’ve had credit problems into the past, your score may suffer, which makes it hard to obtain a conventional financial loan. An extended reputation for good credit, having said that, leads to a score that is high starting doors to the most effective available finance terms. If previous dilemmas have actually acquired that you low rating, bad credit pay day loans along with other online opportunities offer available capital, with a high acceptance prices.

Types of Fast Money Before Payday

Exercising your money contains and close glance at your earnings and outbound financial responsibilities.

month-to-month cost, such as for example lease and instalment bills for your mobile and vehicle, produce a spending that is consistent to policy for. While you handle recurring financial obligations, month-to-month spending grows with extra discretionary acquisitions. Despite your absolute best efforts to keep on course, bad timing, investing emergencies, and increased residing costs can all disrupt your money. Whenever cash is brief, yet costs are up, payday loans offer funding for working candidates with good and bad credit. Extra resources for fast money consist of:

- Credit Cards – Credit and shop cards provide revolving finance terms. The unique credit possibilities enable users to incorporate acquisitions within a month-to-month elegance duration, needing payment at the conclusion of the month’s payment duration. Balances carried over in one month into the incur that is next costs, compounding on long-held balances. The resource that is convenient you to definitely take synthetic at stores as well as on vacation, whenever traveling abroad. But bank card balances could be difficult to handle – specially when making minimal monthly premiums, which might simply take years to credit card debt that is clear.

- Extra Income – Households with two incomes take advantage of increased cash flow, but spending responsibilities can nevertheless keep families that are double-earning step behind. Every person faces unique monetary conditions, so an extra receiving possibility must match-up together with your availability, set of skills, and existing obligations. Do you want in order to make a long-lasting dedication for a job that is second? Or perhaps is a gig that is one-off practical? When you’ve chose to expand profits, checking out opportunities that are various allow you to settle in your safe place. Whether or not the cash arises from a week-end gig that is retail a web business, reselling pre-owned products, additional profits makes it possible to overcome monetary challenges.

- Private Loans – Sometimes called “friends and household” loans, or named cash through the “bank of mum and dad,” private loans complement industry financing that is formal. Casual plans provide benefits, under specific circumstances, you should just take measures in order to avoid typical pitfalls of family and friends loans. Despite your very best motives and good relationships with everybody involved, you really need to treat casual loans like genuine credit plans. The agreement should demonstrably describe payment objectives and spell out the effects for belated payments and loan standard.

- Bad Credit Payday Loans – Credit guide agencies keep files consumers that are tracing credit records. Each person’s reference file is filled with entries pertaining to loans, credit lines, solution agreements, bank balances, as well as other monetary information. Every time a bank evaluates a credit applicant, a credit that is comprehensive is going to be operate on you which calls awareness of previous dilemmas. In case your history includes bad credit, pay day loans provide an easy finance alternative, eliminating a number of the obstacles connected with main-stream banking.